New Retirement Rules For 2025. Under current law, fra will be 67 for people born in 1960 or later. 1, 2025, there’s a new retirement rule.

New provisions of secure 2.0, a federal retirement law, will take effect on jan. Five changes coming to iras and 401(k)s in 2025;

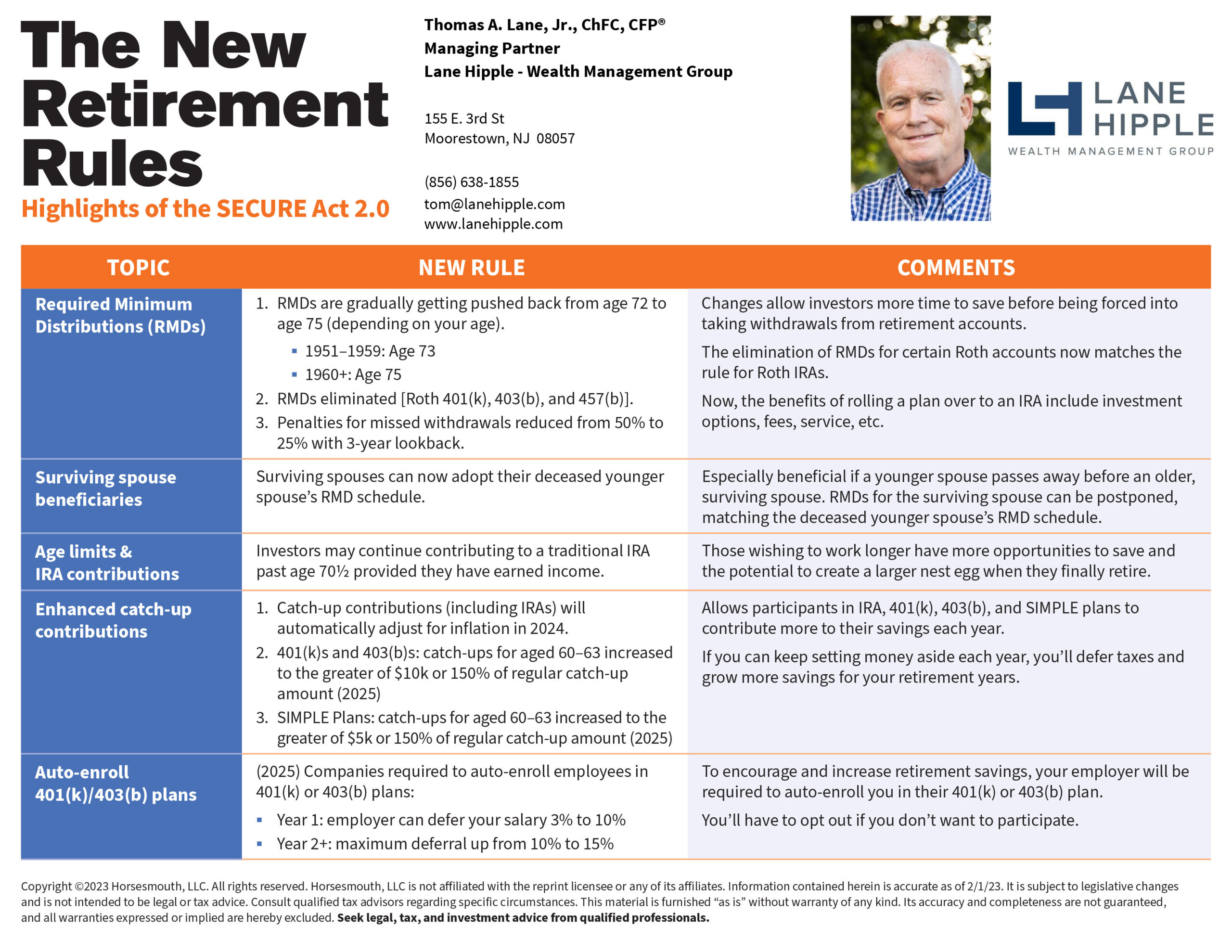

New Retirement Rules What you need to know about the SECURE Act, If you’re 60, 61, 62 or 63 years old, you can contribute at least $10,000.

New Retirement Rules In Powerpoint And Google Slides Cpb, 1, 2025, there’s a new retirement rule.

IRS issues guidance on new retirement catchup contribution rules, In january, several aspects of social security changed, including credits and taxes, check amounts and full retirement age rules.

NEW Retirement Rules 10 Guidelines for a Secure Future, In an effort to increase individual retirement savings, secure 2.0 requires new 401(k) plans established on or after december 29, 2025, to implement an automatic enrollment feature in.

Lane Hipple Wealth Management Group The New Retirement Rules, Retirement savings rule changes to know;

New Retirement Rules Strategies for Succeeding in the Coming Economic, Explore the latest updates from the secure act 2.0 set to take effect in 2025, enhancing retirement savings options.

What Are the New Rules of Retirement? 10 Guidelines for Financial, You’ll reach full retirement age in 2025 if you were born between may 2, 1958, and feb.

Can New Retirement Rules Boost Your Savings? Making Midlife Matter, The updates, stemming from the.

New Retirement Plan Laws What You Need to Know, The setting every community up for retirement enhancement (secure) act 2.0, enacted in late 2025, contained a long list of provisions that are scheduled to roll out over.

The New Rules of Retirement Medicare Life Health, The sweeping new rules impact nearly every taxpayer, including those inheriting a retirement account.