Standard Mileage Deduction 2025. 65.5 cents per mile for business miles driven. The standard mileage rates for the use of a car (also vans, pickups, or panel trucks) for 2025 are:

In the 2025 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became the default. However, if you use the car for both business and personal purposes, you may deduct only the cost of its business use.

The tax cuts and jobs act of 2017 redefined the tax law terrain for many programs, including the mileage initiative.

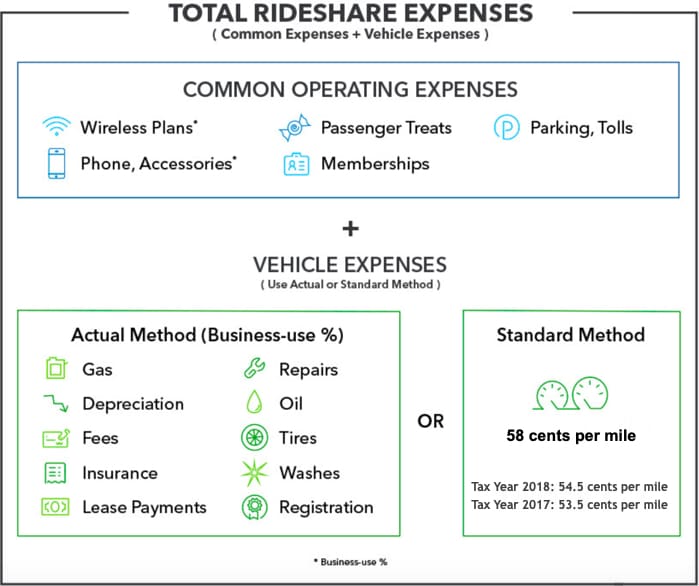

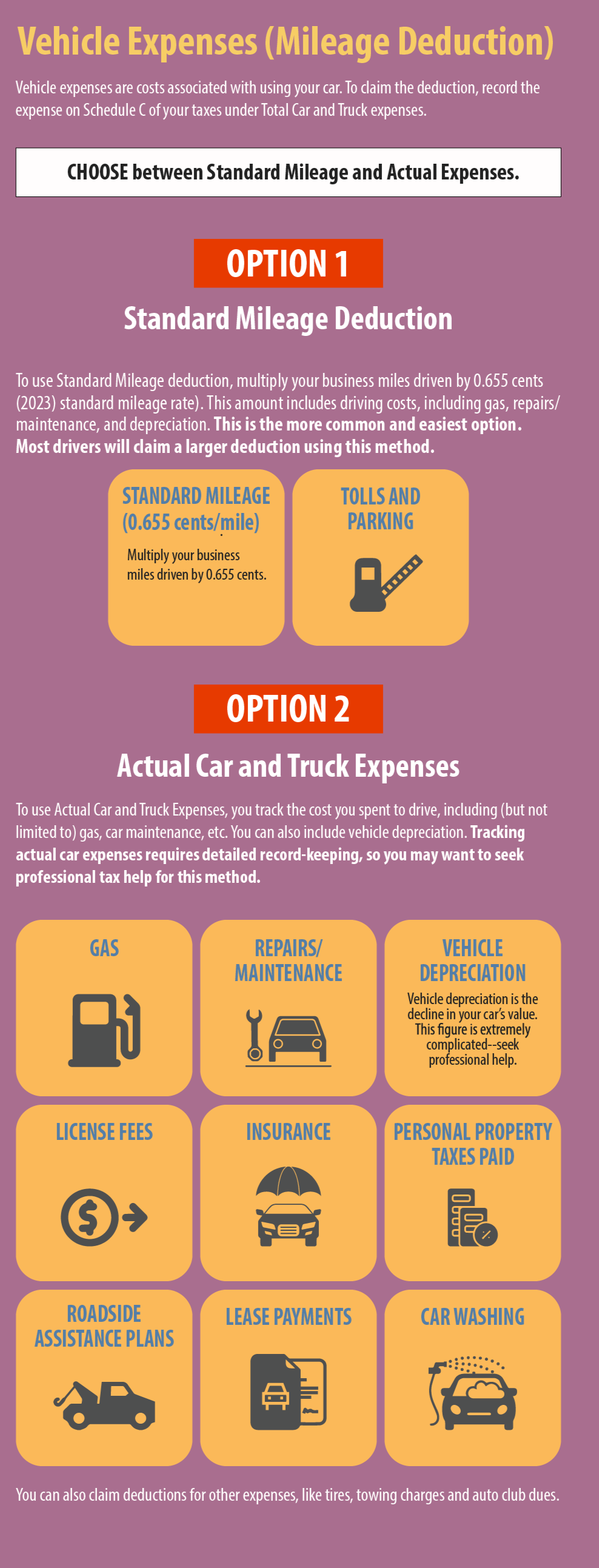

A Quick & Easy Guide to Business Mileage Deduction Methods, Businesses are required to use depreciation and actual expenses when reporting vehicle expense on the business return. Businesses are allowed to use the standard mileage.

Deducting Vehicle Expenses The Standard Mileage Rate YouTube, For the 2025 tax year, the standard mileage rate is 67 cents per mile. Standard mileage rates for 2025 released december 17.

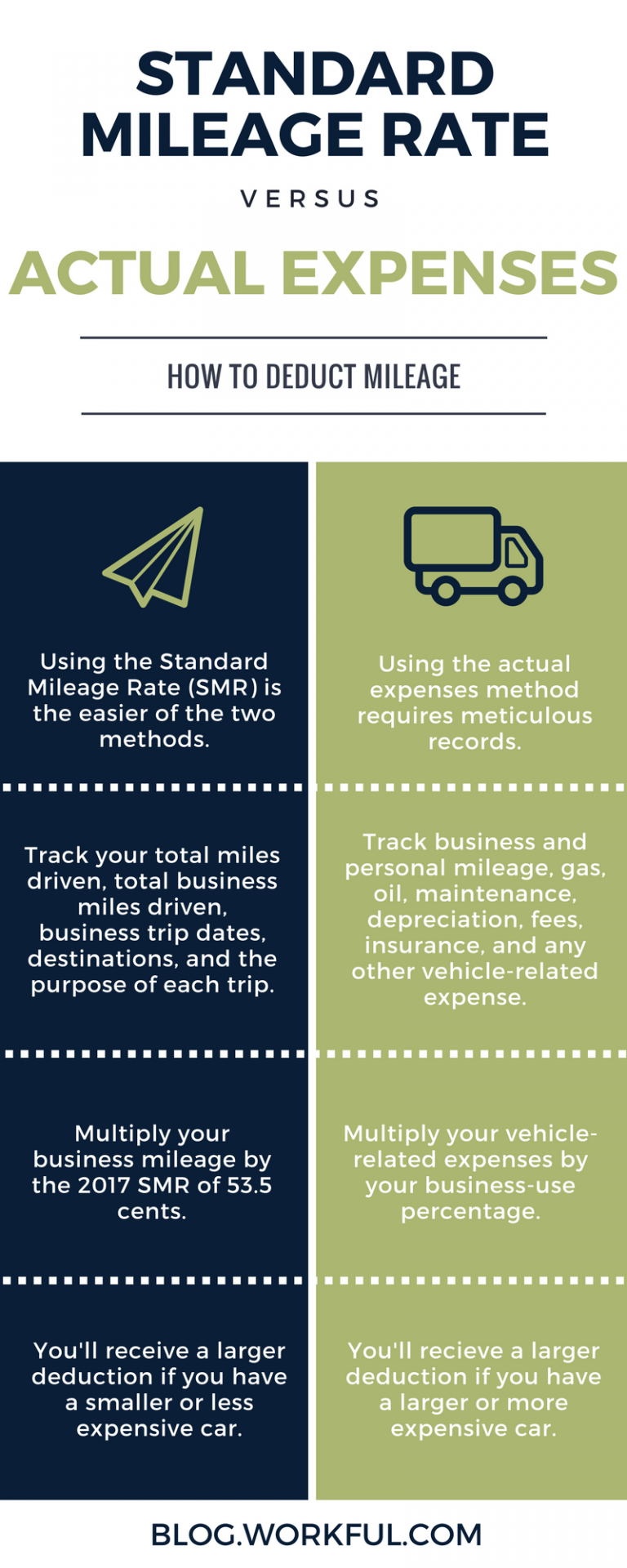

How to Deduct Mileage Standard Mileage Rate vs. Actual Expenses, After decreasing two years in a row, the rate by which taxpayers may compute their deductions for costs of using an automobile for business purposes will go. The irs’s latest guidance provides information on the 2025 standard mileage rates, crucial for calculating deductible automobile expenses related to.

Standard Mileage vs. Actual Expenses Getting the Biggest Tax Deduction, In the 2025 budget, finance minister nirmala sitharaman introduced a standard deduction of ₹ 50,000 for salaried taxpayers and for. Irs issues standard mileage rates for 2025;

How to Easily Deduct Mileage on Your Taxes, In the 2025 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became. 65.5 cents per mile for business miles driven.

Standard Mileage vs. Actual Expenses Getting the Biggest Tax Deduction, 65.5 cents per mile for business miles driven. In the 2025 budget, finance minister nirmala sitharaman introduced a standard deduction of ₹ 50,000 for salaried taxpayers and for.

How to Claim the Standard Mileage Deduction Get It Back, The rate for computing the deductible costs of automobiles operated for a business expense purpose. Standard statewide mileage rate for medical travel.

IRS Now Has A Higher Standard Mileage Rate Because Of Rising Gas Prices, The rate for computing the deductible costs of automobiles operated for a business expense purpose. Standard statewide mileage rate for medical travel.

How to Deduct Mileage Standard Mileage Rate vs. Actual Expenses, Standard mileage rates for 2025 released december 17. In the 2025 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became.

Standard Mileage Rate AwesomeFinTech Blog, The rate for computing the deductible costs of automobiles operated for a business expense purpose. They ensure fair compensation for using personal.